- What is a crypto portfolio tracker?

- What to look for in a good portfolio tracker?

- Top Solana wallet trackers.

- Solscan: main functions, steps to accomplish, and initial framework.

- Cielo Finance: features for advanced monitoring.

- Zerion: multi-network support and interface

- Asset analysis and portfolio management with CoinStats

- Phantom Wallet: tracking features for direct access

- How to monitor your Solana Wallet Address

- How to stalk Solana crypto whales

- Analyzing with Cielo Finance.

- Follow automated bot copytrading strategies on Telegram.

- In summary

- Frequently Asked Questions (FAQ)

- What is the easiest method of checking my wallet balance Solana?

- Can I monitor multiple wallets at once?

- Is it safe to use crypto portfolio trackers?

- Are there free functionalities for monitoring Solana?

Gaining traction in the cryptocurrency market, Solana is one of the fastest cryptocurrency blockchains, known for its scalability features.

Blockchain is becoming more and more popular, and thus, there are many reasons why users would want to track their wallet activities and transactions. Some of those reasons include checking their savings, checking recent deposits and withdrawals, and investigating ATMs and other transactions they deem suspicious. Furthermore, tracking the successful sending and receiving of transactions alongside Solana is also captivating.

What is a crypto portfolio tracker?

A crypto portfolio tracker is an application that tracks prices and multiple cryptocurrencies alongside their relevant networks. It can also be used for tracking other attributes like real-time estimates of portfolio value, reproducibility within bounds, and tracking losses and how far you have deviated from desired wealth.

These tools allow them to have relevant information regarding the aggregate capitalizations of their tokens and prices pertaining to them seamlessly. Shocks aligned with structure or other external changes within the market and basing decisions on them changes within the market can also be done efficiently using these tools.

While a lot of trackers are specialized in one currency, many others offer more sophisticated aids such as working with contracts on different currencies, notifying clients with results of their specified benchmarks, and other analytic aids. A market that’s too aligned with what changes is also being deployed allowing investors to make use of alternative currencies.

What to look for in a good portfolio tracker?

With the multitude of crypto asset portfolio trackers available, choosing one can often feel overwhelming.

Here are some of the criteria you should analyze when selecting a crypto portfolio tracker:

- Interface: The graphical representation must have a straightforward and favorable layout having easy and simple navigation mechanisms to manage the portfolio.

- The ability to customize the interface to personal preference which includes but is not limited to themes, widgets, displayed info, etc.

- Functionality: Extensive portfolio features such as price tracking in real time, notifications for market changes, analytics, and even forecasts.

- Support for automatic data import from exchanges and wallets for easier portfolio management.

- Possessing and analyzing asset performance and data over time using historical data and charts.

- Support for Solana and other networks – compatible with the majority of blockchains in circulation including Solana, Ethereum, Binance Smart Chain, and many other popular networks.

- Possessing capabilities for tracking and managing assets across various blockchains through single throttling.

- Security: Availability of security features such as two-factor authentication granting access only authorized users alongside data encryption and protection from unauthorized access.

- Disclosure of a transparent privacy policy safeguards provisions on users’ personal data, which is out of remit to the tracker.

- User feedback: Reviews, predominantly favorable ones demonstrate high satisfaction among users suggesting reliability and convenience exemplified in the tracker.Consistent maintenance and monitoring support from developers for updating and bug repairs.

Having a tracker that meets the above requirements will provide easy and secure management of your cryptocurrency portfolio.

Top Solana wallet trackers.

Portfolio trackers allow users to configure the possible risks, portfolio optimization according to—certain strategies, and take appropriate and well-informed actions in the exchange.

The simultaneous observation of multiple tokens, or tracking dynamics can be exceedingly difficult. Special trackers can assist with this. Let’s discuss some of the most popular programs.

Solscan: main functions, steps to accomplish, and initial framework.

Candidate trackers are Solana’s alternative block explorer. It specializes in curating information concerning the blockchain including transactions, contracts, accounts and other pertinent data relevant to them all.

For Solana users, knowing the insight of explorers can be quite beneficial. Most importantly, those who are able to navigate through Solscan and are active with the network, or those who happen to face technical difficulties. Just as simple as going to the Explorer website directly solves the issues.

Cielo Finance: features for advanced monitoring.

Cielo is the first information layer of web3. It also allows users to search and track wallets alongside tokens and includes them in the on-chain activity feed as per real-time. Activity including transactions are accessible from the Cielo web app or from Discord/Telegram with the Cielo bot and can be sifted through by category, amount, and network.

From monitoring whales to private wallets, Cielo reveals the on-chain transactions tagged with higher priority.

Zerion: multi-network support and interface

Zerion serves as a social web3 smart wallet that lets users manage their DeFi and NFTs on multiple chains as well as thousands of protocols. Through innovation in user experience design, Zerion integrates all wallets, networks, and DEXs to provide a non-custodial solution for global analytics across numerous blockchains.

The interface is tailored to suit users’ needs. With Zerion, users can visualize their portfolios, discover new investment opportunities, and perform transactions seamlessly in real-time, hence making the DeFi experience much simpler.

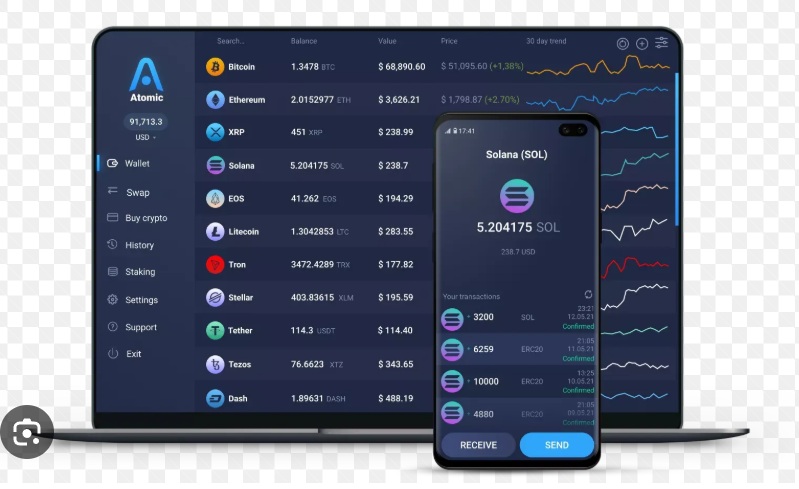

Asset analysis and portfolio management with CoinStats

Considered one of the best crypto portfolio management tools, CoinStats provides users with an intuitive interface to view and manage all their cryptocurrencies and DeFi assets in a single place. CoinStats is very flexible due to its cross-platform nature; it adds support for a large number of wallets and exchanges.

Moreover, CoinStats enables trades directly on their platform. By figuring out whether Coinstats is profitable and safe, users can seamlessly exchange cryptocurrencies and tokens without visiting other exchanges. Furthermore, users can earn up to 20% annualized returns on their crypto and DeFi assets, which is an added benefit.

The platform offers a plethora of useful features that can be useful for monitoring the activity of your portfolio, including profit and loss (PnL), net worth data, and relevant news about the cryptocurrency industry. Moreover, CoinStats tax reporting is user-friendly, allowing seamless readiness during tax season.

Phantom Wallet: tracking features for direct access

Phantom Wallet is a non-custodial crypto wallet and browser extension aimed at streamlining the management of digital assets. Initially, Phantom was built for the Solana blockchain ecosystem; however, it now supports Ethereum, Polygon, and Bitcoin. Due to concerns over the security of the Phantom Wallet, many users wonder whether Phantom Wallet is safe, which has made it one of the most prominent wallets among Solana ecosystem users.

Users are able to securely store, send, receive, and exchange cryptocurrencies and NFTs through Phantom, in addition to engaging with numerous DeFi protocols. Phantom has quickly become one of the most sought-after wallets among the crypto community because of its user-friendly interface, which allows even the newest crypto users to navigate within minutes, and Solana’s rise in popularity.

How to monitor your Solana Wallet Address

Steps to Solana wallet tracking with third-party services such as Solana Tracker are super simple and effective. Simply navigate to the Explorer section of the Solana Foundation’s website, and insert the public key (the address of your desired wallet) into the search box. Explorer will retrieve extensive details about the wallet, its current balance, a complete list of transactions, as well as any relevant NFTs and tokens. Read more about how to monitor your Solana wallet address above.

Other third party services provide enhanced tools such as portfolio analytics and real-time transaction alerts. Solana Tracker for instance enables users to monitor multiple wallets under a single account, offers a detailed transaction history, and even allows users to create custom alerts.

How to stalk Solana crypto whales

By tracking and gaining insights from the movements of different crypto whales, you can come up with an informed trading decision. In this article, we will delve into the best tools designed for tracking crypto whale wallets, as well as trade copying and wallet analisys.

To spot tokens with recent price spikes, you will need to do some work with the leaderboard. These tokens need to be pasted into the tracker where whale wallets can be located and token distribution can be analyzed.

Analyzing with Cielo Finance.

Now Cielo Finance has advanced functions that allow transaction value filters as low as $1 to be set using your Telegram bot. From Cielo’s dashboard, you can set the specified blockchains along with USD transaction amount and type.

These wallets that are followed by users will now show the latest transactions. Results can also be narrowed down to specific areas of interest. NFT traders are not left behind since the leaderboard also shows top holders with their PnL. Average buy price is available too and traders who sold off their entire collection for a particular collection fired off are visible.

Follow automated bot copytrading strategies on Telegram.

Make sure to select only verified bots. With bot copy trading, traders of any level can access the strategies of more sophisticated traders. This method makes trading easier, but more importantly, it helps users learn how best to interact with the market’s strategies.

Pick only those copy strategies that suit your needs. Conduct proper historical analysis, and modify strategies to fit the Solana ecosystem, along with good management techniques.

In summary

For the novices in the crypto space, keep exploring new avenues, gather knowledge, and encircle quickly. Experienced investors will find the trackers useful to refine their investment plan which will, in turn, increase their return on investment.

Having selected the most appropriate tool for monitoring ROI, knowing how to make the best use of it is critical. Check the following recommend guides:

● Portfolio Setup: Fill in your investment’s details into the profitability tracker. This feature enables the analysis of ones assets.

● Track Regularly: The portfolio must be tracked on a regular basis every time changes such as new purchases or sales, or changes in value are made. This practice will make sure that the data accurately reflect the current proportions.

● Analyze Metrics: Use investment analytics metrics provided by the tool to analyze performance and focus on total and one-year profitability, riskiness, Sharpe ratio, and volatility.

● Adjust for Asset Concentration: Look for an over diversification or a concentration of assets in certain areas. If needed, balance out certain assets so that it won’t disrupt the balance.

By taking advantage of these functionalities of your tool, you are able to better track your investment and find areas which need adjustment so that your strategies can yield the greatest amount in return.

Frequently Asked Questions (FAQ)

What is the easiest method of checking my wallet balance Solana?

The trackers allow monitoring of the balance held in any wallet tokens. It only requires network and wallet detail specification, as well as the token in question.

Can I monitor multiple wallets at once?

Yes, with the help of some specialized software, you can monitor a number of wallets simultaneously.

Is it safe to use crypto portfolio trackers?

Absolutely, they are safe to utilize as long as you acquire the software from their authentic sources.

Are there free functionalities for monitoring Solana?

Yes, you can find free resources online for tracking crypto wallets in various blockchains which includes crypto wallet tracking and analyzing for Solana.